Bumitama has recorded robust and accelerated growth of its key business metrics over the past decade. Our rise to prominence in the global palm oil industry is underpinned by a firm commitment to pursue excellence through discipline which have proved instrumental in our best-in-class agronomic practices in keeping productivity resilent even amidst weather disruption years.

This commitment is manifested in an all-around suite of strengths that has propelled Bumitama to outperform many of its peers, amidst the challenging dynamics that shaped the global palm oil industry in the past decade.

On the contrary to declining palm oil yield in the industry, past extensification efforts, combined with continuous improvement in production processes, have bolstered Bumitama’s FFB (internally sourced) and CPO production volumes to climb significantly over the last ten years, with a CAGR of 9.9%. The Group has consistently stayed on the path towards achieving higher yields and extraction rates by investing in research and development, technology, and best practices in cultivation of oil palm. These efforts have made the Group one of the most efficient producers in the industry today, boasting a CPO yield of 4.8 tonnes per ha in 2022.

In recognition of its operations’ superiority, the Group has received numerous accolades which include having listed as Forbes Asia’s 200 Best Under a Billion 2013, earned Frost & Sullivan Indonesia’s Excellence Award in 2014, and obtained the Best Managed Small Cap Company in 2016 and the Most Outstanding Company in Singapore for the Decade (2010-2019) in 2019 from Asiamoney.

On the back of industry-leading production processes, Bumitama’s financial fundamentals have shown a rapid and steady ascent relative to the industry, despite pronounced swings in global CPO prices over the past several years.

Revenue rose more than five-fold from 2011 to 2022 (a CAGR of 17%), while net profit sustained an 12.7% CAGR over the same period. The Group keeps its balance sheet lean, with a low net gearing ratio of 0.23x. Among other factors, this led to RAM Ratings reaffirming the Group’s Sukuk 2014/2029’s AA2/Stable rating in early 2023,

The Group’s financial excellence has been acknowledged with The Edge Billion Dollar Club – Most Profitable Company (Agriculture Sector) Award for 3 years in a row (2017, 2018, 2019), named as The Straits Times’ Distinguished Member of Singapore Fastest Growing Companies in 2020, and made it to the list of The Financial Times’ High- Growth Companies Asia-Pacific in the same year.

Bumitama’s long-standing focus on delivering high shareholder value are reflected in its commitment to provide high quality disclosures and active engagement with the capital market community, for which it has received Asiamoney’s accolades namely Best for Investor Relations and Best for Shareholders’ Rights and Equitable Treatment.

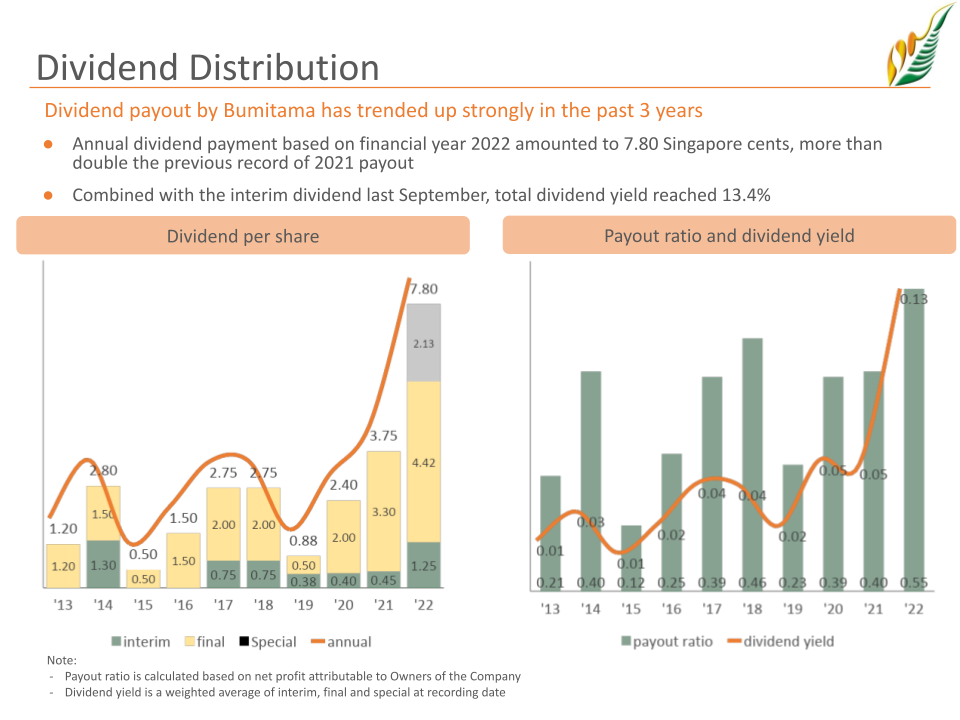

Furthermore, the Company maintains an attractive dividend policy of up to 40% payout ratio, with total dividend payment from FY2022 net profit amounting to 7.8 Singapore cents, more than double the 8-year average and highest on record. The rising dividend payment over the years is a good indication of our commitment to pursue long-term value maximization to shareholders.

As of end of 2022, Bumitama’s total planted area of 187,628 hectares is spread across the Indonesian provinces of Central Kalimantan, West Kalimantan, and Riau – areas with ample precipitation and temperature range suitable for oil palm cultivation. As 96.4% of the planted area is either maturing, closing in towards prime age, or being in the peak productivity phase, Bumitama is poised to sustain growth in production volume in the upcoming years. Weighted average age of its nucleus and smallholders plantation as of 31 December 2022 is 12.3 years.

The Group’s plantations are located in close proximity to the fifteen palm oil mills it operates, thus expediting FFB evacuation and processing to ensure optimum productivity, and becoming one of the nation’s most efficient producers by reducing overall transportation-related costs while keeping CO2 emissions low. With a total annual FFB processing capacity of 6.39 million metric tonnes, these mills ensure consistent, high quality CPO output. In 2022, Bumitama sold 1.1 million metric tonnes of CPO and 245.9 thousand metric tonnes of PK.

Plasma estate comprising 55,529 hectares constitute a sizeable 29.6% of total planted area under the Group’s management. Fruits from the community owned plasma estates, together with the FFB from the independent smallholders which makes up 22.2% of total FFB in 2022, has lead to a steady supply of FFB feedstock on top of harvest from nucleus estates under management. Sourcing from local communities allows us to apply our sustainability policy requirements in relation to third parties and thus better manage the environmental and social issues in our supply chain. Although some challenges remain, we are positive that the communities are being provided with optimal support to improve their livelihoods in a sustainable manner.

As one of the first few oil palm growers to adopt a “No Deforestation, No Peat and No Exploitation” policy, Bumitama is widely recognised for pioneering sustainability initiatives, all of which supports its comprehensive Sustainability Policy. Its groundbreaking Bumitama Biodiversity and Community Project (“BBCP”), now running in its sixth year in West Kalimantan, continues to evolve as it blends efforts to augment ecosystem services with those that strengthen local communities’ self- reliance and elevate their living standards, and leads the way to galvanise an industry- wide movement towards more sustainable operations.

Driven to increase transparency and product traceability, Bumitama strives to obtain sustainable certifications beyond its own managed plantation by working closely with its plasma and independent smallholders. With regards to the context of responsible sourcing, we are constantly working towards full traceability of all FFB processed within our mills. To further amplify the positive social impacts of our endeavours, the Group cultivates good relations with local communities, government bodies, and civil society partners through various multi- stakeholder collaborations across our operational areas.

Bumitama’s discipline in managing its operations and finances has been forged in the framework of corporate governance that champions excellence through a culture of compliance as well as prudent and comprehensive risk management. By adhering to the Ministry of Agriculture’s Indonesian Sustainable Palm Oil (“ISPO”) certification scheme’s requirements and voluntary certification schemes’ requirements, such as those of the Roundtable for Sustainable Palm Oil (“RSPO”), the Group stays ahead of the curve in the area of regulatory, social and environmental compliance. This has earned Bumitama Asiamoney’s Best Overall for Corporate Governance, Best for Disclosure & Transparency, and Best for Responsibilities of Management and the Board of Directors awards.

Our annual general meeting of shareholders is an opportunity for our shareholders to gain insight and information on our operations, business developments, financial reports, and any other relevant activities or documentation. Please find relevant documentation from past meetings below:

19 April 2024 06.25 PM SGT

Data provided by Refinitiv 15 minutes update interval

(0.00%)

| General Enquiries | : | general@bumitama-agri.com |

| Investor Relations | : | investor.relations@bumitama-agri.com |

| Sustainability & CSR | : | sustainability@bumitama-agri.com |

| Recruitment | : | recruitment@bumitama-agri.com |

10 Anson Road, #11-19 International Plaza, Singapore, 079903

Tel:+65 6222 1332 | Fax:+65 6222 1336

© 2022 Bumitama Agri. All Rights Reserved. Terms of Use | Privacy Policy.